Forex Volatility

Learn some of the key announcements that can affect the forex market. The volatility of the forex market is a statistical indicator that reflects variations of prices during a certain time period.

Forex Volatility Graph Zigzag Ea Forex Download

Forex Volatility Graph Zigzag Ea Forex Download

You can define the time frame by entering the number of weeks.

Forex volatility. In order to navigate the periodic chaos of the currency trade, it is important to understand the differences in forex volatility. There aren’t that many disadvantages to trading forex, but one disadvantage is… lecture: Forex volatility charts tell you which currency is most volatile relative to each other.

Volatility factor 2.0 is a robot that has been designed by fxautomater. Before choosing a financial instrument, a trader needs to know what fluctuations to expect, since this determines a potential profit. There is no way to determine the exact volume.

1 they spend a substantial amount of time out of the market. Volatility is an important factor in building a forex trading strategy because it measures the currency rate’s potential to change — and to profit from an fx trade, the rate has to change (unless you are trading options). A forex volatility meter that dispenses with direction and tells you purely about the magnitude of volatility is the average true range indicator (or atr).

Volatility of prices for financial instruments is an important criterion for traders. Gain/loss is optimized for forex cross (pips). The forex volatility calculator calculates the historic volatility for major and exotic pairs over different time frames.

If you are looking for a forex broker, you may wish to view my best forex brokers for some inspiration. You have to define the period to calculate the average of the volatility. Volatility breakout systems generally have the following characteristics:.

Before we take a closer look at the most volatile currency pairs in forex, it’s important to understand exactly what volatility means and how it can be measured. So i post here my version. Discover the concepts of liquidity and volatility, and how they affect the forex market.

2 they generate a high percentage of winning trades but earn a small average profit per trade. The forex volatility calculator tool generates the daily volatility for major, cross, and exotic currency pairs. If you would like to practice trading with volatility indicators, you can open an account with a forex broker and download a trading platform.

Moving averages are probably the most common indicator used by forex traders and although it is a simple tool, it provides invaluable data. Simply put, moving averages measures the average movement of the market for an x amount of time, where x is whatever you want it to be. If not, we recommend you to get more information on the subject before reading article volatility explained in simple words.

The following table represent the currency's daily variation measured in pip, in $ and in % with a size of contract at $ 100'000. Bollinger bands average read more… Here we will talk about the most volatile currency pairs in the foreign exchange (forex) market in 2021.

U have to copy indicator into mql/indicators folder and attach it to a chart. You can define the time frame by entering the number of weeks. You can switch the search mode to pips or percent.

Historical volatility is the normal price action over a period of time (i.e. If you employ short term trading strategies like scalping or use 15 min charts or less, then you want to refer regularly to the forex volatility chart. This is where you get a big picture of what's moving now and

Volatility is used to estimate volume. We should note that by definition, volatility tends to change over time and is not a constant. Put simply, volatility in forex is the extent to which your currency pair fluctuates in value.

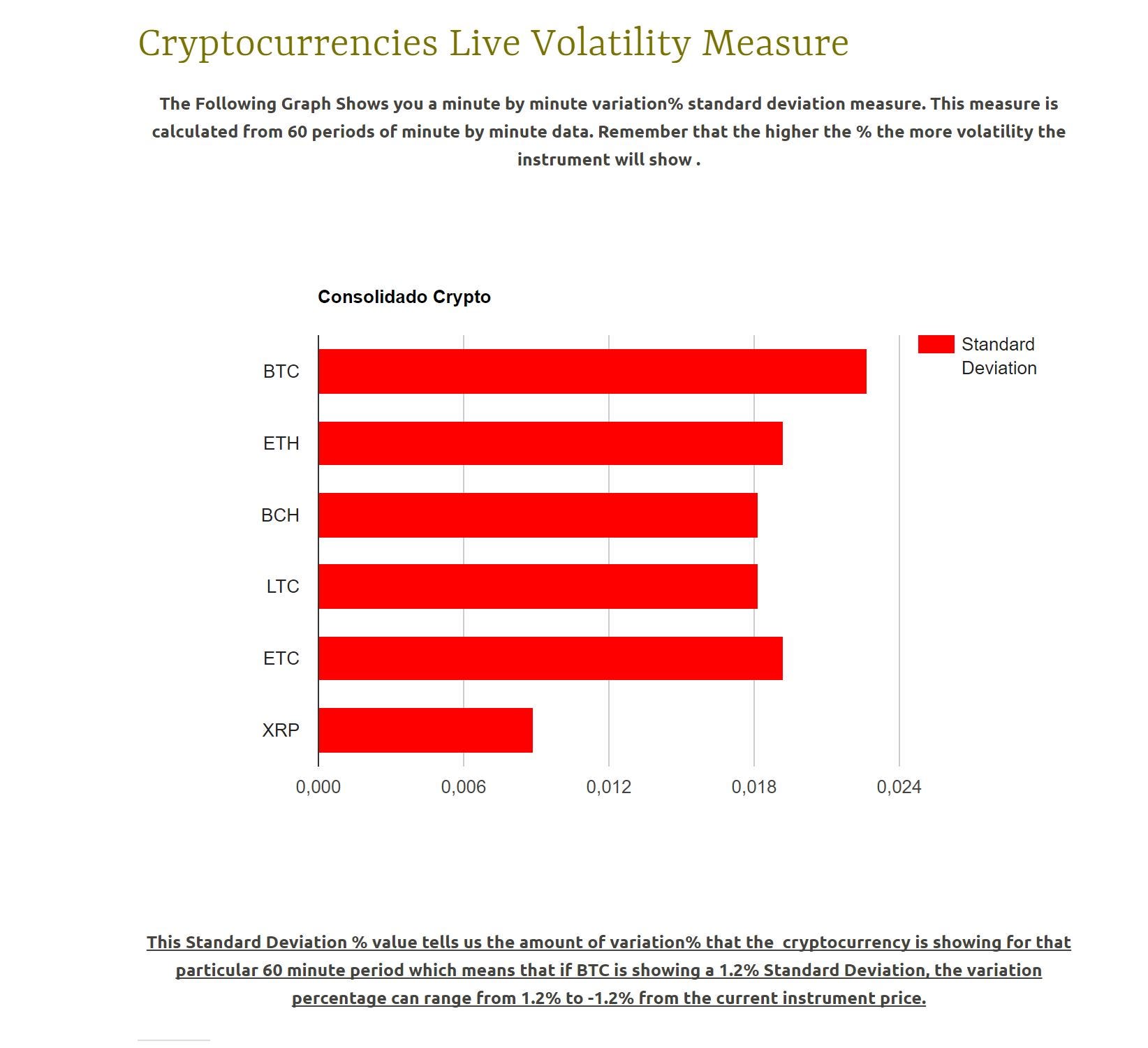

Volatility filter type in the volatility criteria to find the least and/or most volatile forex currencies in real time. Volatile markets are characterized by sharp jumps in price, and volatility breakout systems are designed to take advantage of this type of price action. Volatility in forex trading is a measure of the frequency and extent of changes in a currency’s value.

When it comes to volatility trading, there are two types to be concerned with: Using these indicators can help you tremendously when looking for breakout opportunities. A month or a year).

It could be interesting to trade the pair which offer the best volatility. I had many request for my mt4 version of famous volatility trading system. However, drastic and sudden movements are also possible in the forex market.

The system has been enhanced by useful features like broker spy module, money and risk management systems. You are probably familiar with the concept of volatility. Volatility is a word that’s used a lot in the world of trading.

Fundamental analysis key economic announcements. The calculation is based on daily pip and percentage change, according to the. It focuses on performing algorithms that allow trading in a way where the market goes having a stable, smooth and predictable profit.

U can anyway use it for cfd or stocks or futures contracts. The volatility factor 2.0 pro forex robot includes a vast array of new features, trading 4 of the major currency pairs in the eurusd, gbpusd, usdjpy and usdchf. Forex volatility calculator calculates the historic volatility for major and exotic pairs over different time frames.

These lines are variously known as channels, envelopes, or bands. More traders trading at the same time usually results in the price making small movements up and down. We created this page with this forex volatility chart as a free tool for you to guide you in your trading journey.

Liquid markets such as forex tend to move in smaller increments because their high liquidity results in lower volatility. The calculation is based on daily pip and percentage change, according to the chosen time frame. The calculation is based on daily pip and percentage change, according to the chosen time frame.

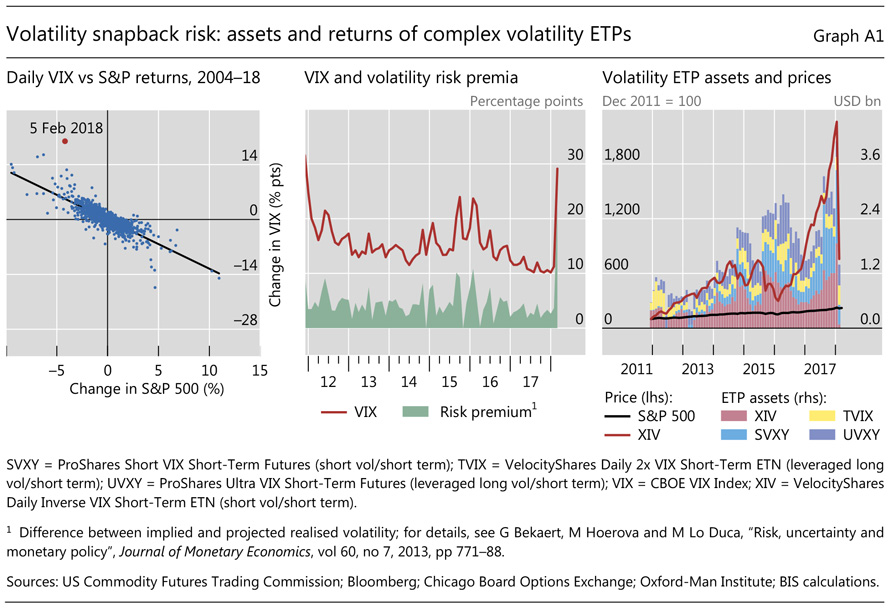

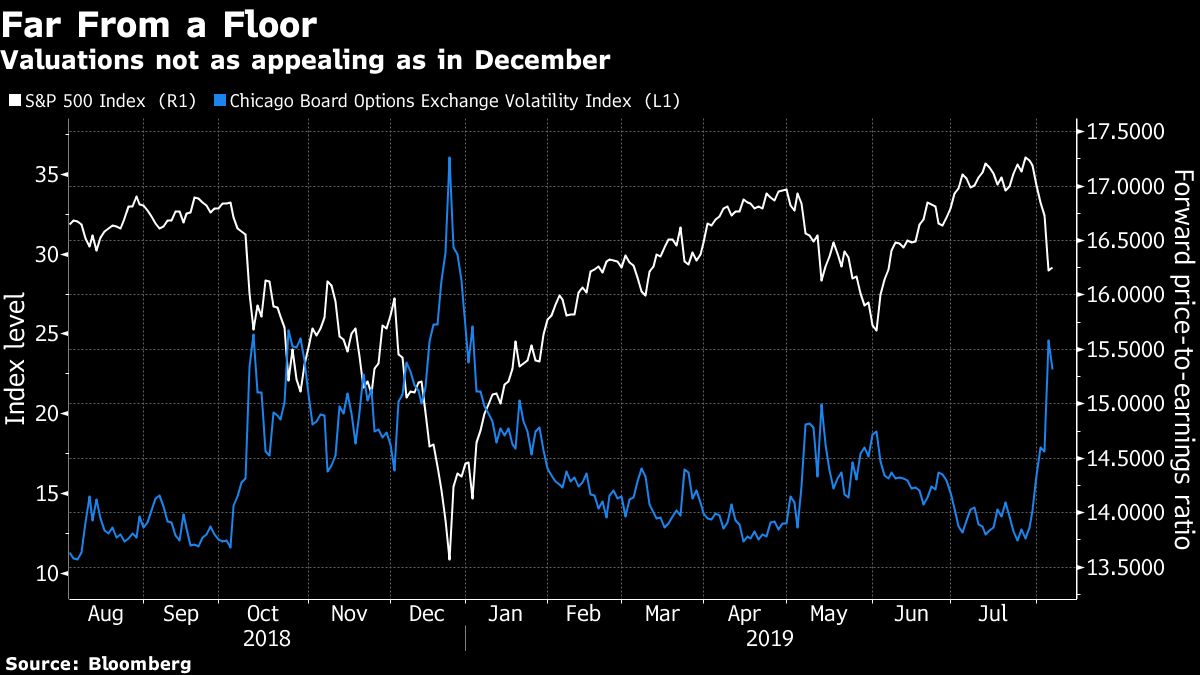

A currency might be described as having high volatility or low volatility depending on how. Derived from the price inputs of the s&p 500 index options, it provides a measure of market risk and investors' sentiments.

What Does the Lull in Forex Volatility Mean for Bitcoin?

What Does the Lull in Forex Volatility Mean for Bitcoin?

Are Forex Markets Underpricing Volatility? Forex Trading

Binary/forex/volatility Indicator Business Nigeria

Forex Volatility Graph Newest Forex Ea

Forex Volatility Graph Newest Forex Ea

Take The Stress Out Of Forex Volatility Forex Friend

Take The Stress Out Of Forex Volatility Forex Friend

Forex Volatility Levels Metatrader 4 Indicators

Forex Volatility Levels Metatrader 4 Indicators

Forex Volatility Per Hour Forex Robot Reviews 2019

Forex Volatility Per Hour Forex Robot Reviews 2019

Forex Volatility Map Forex Auto Scalper Free Download

How to Use a Forex Volatility Indicator

How to Use a Forex Volatility Indicator

Forex Volatility Levels Metatrader 4 Indicators

Forex Volatility Levels Metatrader 4 Indicators

Forex Volatility Hypertrend Indicator for MT4 free Forex

Forex Volatility Hypertrend Indicator for MT4 free Forex

Forex Volatility App Forex Flex Ea Version 4.65

Forex Volatility App Forex Flex Ea Version 4.65

How to trade during periods of low volatility in Forex Markets

How to trade during periods of low volatility in Forex Markets

Forex Volatility Charts Forex Gold Trader Ea Free Download

Forex Volatility Charts Forex Gold Trader Ea Free Download

Comments

Post a Comment