Margin Level Calculator Forex

300,000 / 200 * 1.13798 = $1706.97. Do not invest money that you cannot afford to lose.

Forex and cfd trading involves significant risk to your invested capital.

Margin level calculator forex. Let’s say a trader has an equity of $5,000 and has used up $1,000 of margin. Dream draw liteforex raffles a dream house, a brand new suv car, and 18 super gadgets (eur/gbp) = 0.7369 leverage = 200 margin required = 100000 / 200 * 0.7369 = 368.45 margin required is £368.45.

1 * 100 * 42.96 * 0.04 = $171.84. Although most trading platforms calculate profits and losses, used margin and useable margin, and account totals, it helps to understand these calculations so that you can plan transactions and determine potential profits or losses. The more margin level a trader has, means they have the more available free margin.

The concept of forex margin, the way to calculate forex margin level using the margin calculator. The forex margin calculator will then calculate the amount of margin required. If the margin level is 100% or less, most trading platforms will not allow you to open new trades.

Use our forex margin call calculator to determine when a forex position will trigger a margin call (request for more collateral) or a closeout of the trade. Level of experience, and risk tolerance. The required minimum amount in your account, which is necessary to open the desired position.

Trading cryptocurrencies or any other financial instrument involves a significant level of risk and may result in a total loss of your investment. You might also find our how much money do you need to start trading forex article useful. The margin level is 250%.

Forex margin call & closeout calculator. Brokers use margin levels to determine whether forex traders can take any new positions or not. While having losing positions, your margin level goes down and becomes close to the margin call level.

Type the amount you would like to calculate, using numbers only. When margin call level setting is 100%, you will not be able to take any new positions if your margin level reaches 100%. Before deciding to invest your money, you should.

It is the ratio of your equity to the used margin of your open positions, indicated as a percentage. Margin ratio is used for expressing the forex leverage in a ratio format. Margin used indicates the amount you have actually used in a forex trade, excluding any leverage.

Margin level = (equity / used margin) * 100. This website is operated by trading point of financial instruments limited, registration number he251334, with registered address at 12 richard & verengaria street, araouzos castle court, 3rd floor, 3042 limassol, cyprus. His margin level, in this case, would be ($5,000/$1,000) x 100 = 500%.

You should consider carefully whether investing in bitcoin or any other instrument offered by cryptoaltum is appropriate to your financial situation. A margin level of 100% implies that account equity is equal to used margin. Maximum leverage and available trade size varies by product.

Tip the profit calculator can also be used to calculate, in a simple and fast way, how much money and pips will be deducted from the account equity with a losing trading position by inputting in the close price field the stop loss level price. Margin level = (equity / used margin) x 100% 250% = ($1,000 / $400) x 100%. You should not trade or invest unless you fully understand the true extent of.

As a formula, margin level looks like this: For example, let’s say a forex broker has a 3.3% margin requirement for eur/usd, and a trader wants to open a position of 100,000 units. If you see a tool tip next to the leverage data, it is showing the max leverage for that product.

There is a high level of risk involved when trading leveraged products such as forex/cfds. A margin level of 0% means that the account currently has no open positions. Margin level allows a trader to know how much funds are available to use for new trades.

Margin call is a call from your forex broker when your account balance goes below the maintenance margin. You could lose some or all of your initial investment. How to use the margin percentage calculator.

58.42% of retail investor accounts lose money when trading cfds with this provider.you should not risk more than you can afford to lose, it is possible that you may lose the entire amount of your account balance. Margin calculator margin calculator values. Margin call level is typically determined by the forex broker.

Please contact client services for more information. Money › forex how to calculate leverage, margin, and pip values in forex. For forex, the margin calculation works as follows:

Please read and ensure you fully understand our risk disclosure. In the forex market, margin level is utilized by traders within their trading accounts to leverage more of their investment. It is the broker who determines the margin call level.

Margin calculator can be used to evaluate the margin requirements of a position according to the given leverage and account base currency both in trade and account currency. Foreign exchange trading carries a high risk of losing money due to leverage and may not be suitable for all investors. Margin level = equity/margin used x 100.

Margin levels are a реrсеntаgе vаluе bаѕеd on the аmоunt of ассеѕѕіblе usable mаrgіn vеrѕuѕ uѕеd mаrgіn. The margin calculator, the pip value calculator, the currency converter and the swaps calculator are all available to help with risk management and to help monitor each trade position. Margin level is a percentage representing used margin vs equity.

Using all the formulas illustrated above, and the data supplied, the forex margin calculator tell us that to open a trade position, long or short, of a 0.10 lot eur/usd, with a 30:1 leverage trading account, and with the current eur/gbp exchange rate of 0.90367, we would need a margin of £ 301.22. Choose the currency pair for which you would like to calculate the margin percentage. Now that we know the equity, we can now calculate the margin level:

Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You can also calculate your margin level using their margin calculator. When you have winning positions, your margin level goes up.

In the example, since your current margin level is 250%, which is way above 100%, you’ll still be able to open new trades. Required margin = volume * contract size * open price * margin % example: Required margin = trade size / leverage * account currency exchange rate (if different from the base currency of the pair traded)

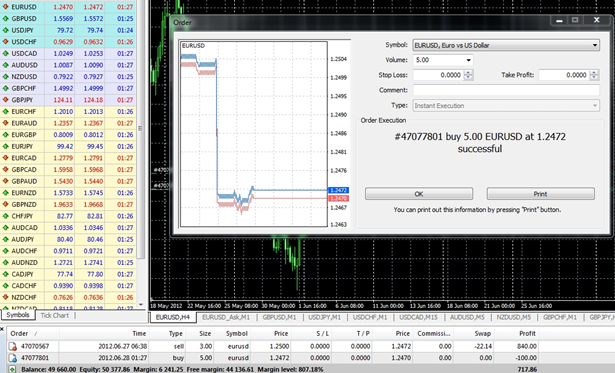

Lite Forex Margin Calculator Forex Ea Free

Lite Forex Margin Calculator Forex Ea Free

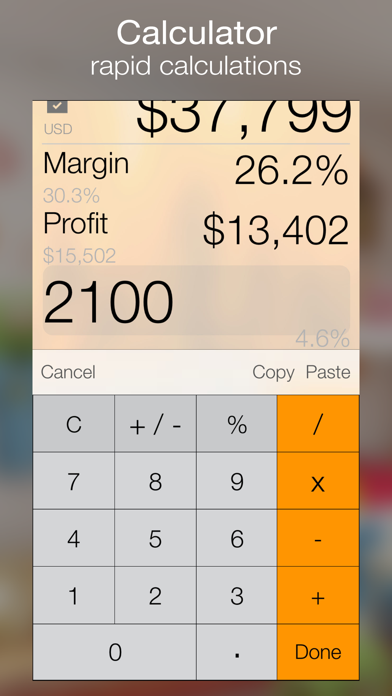

Simple Forex Margin Calculator Forex Robot Trader Mt4

Simple Forex Margin Calculator Forex Robot Trader Mt4

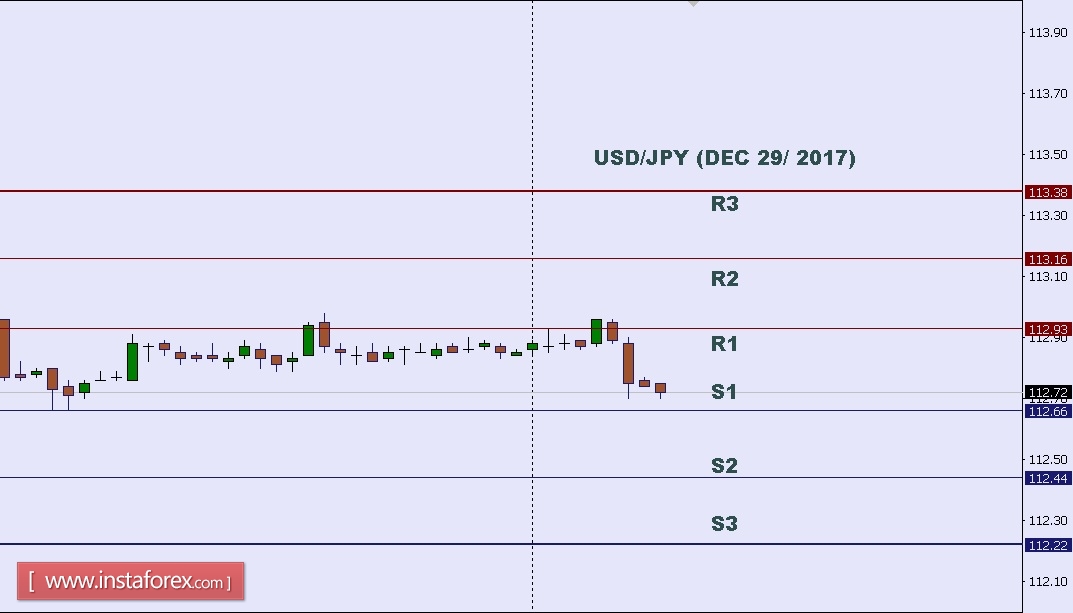

Margin in Forex Trading & Margin Level vs Margin Call

Margin in Forex Trading & Margin Level vs Margin Call

Margin Level Forex Forex Trading 2019

Margin Level Forex Forex Trading 2019

Forex Margin Call Level The Forex Scalping Strategy Course

Forex Margin Call Level The Forex Scalping Strategy Course

Forex Margin Level Percentage Calculator Are Forex

Margin Calculator In Forex Forex Ea For Sale

Margin Calculator In Forex Forex Ea For Sale

Forex Margin Level Percentage Calculator Forex Breakout Bot

Forex Margin Level Percentage Calculator Forex Breakout Bot

Lite Forex Margin Calculator Forex Zigzag System

Lite Forex Margin Calculator Forex Zigzag System

Forex Lot Size Calculator Mt4 All About Forex

Forex Lot Size Calculator Mt4 All About Forex

Warning Different Forex Brokers Have Different Margin

Warning Different Forex Brokers Have Different Margin

Margin Calculator For Forex Forex Success System

Margin Calculator For Forex Forex Success System

Currency Option Margin Calculator Forex System Free

Currency Option Margin Calculator Forex System Free

Lite Forex Margin Calculator Forex Zigzag System

Lite Forex Margin Calculator Forex Zigzag System

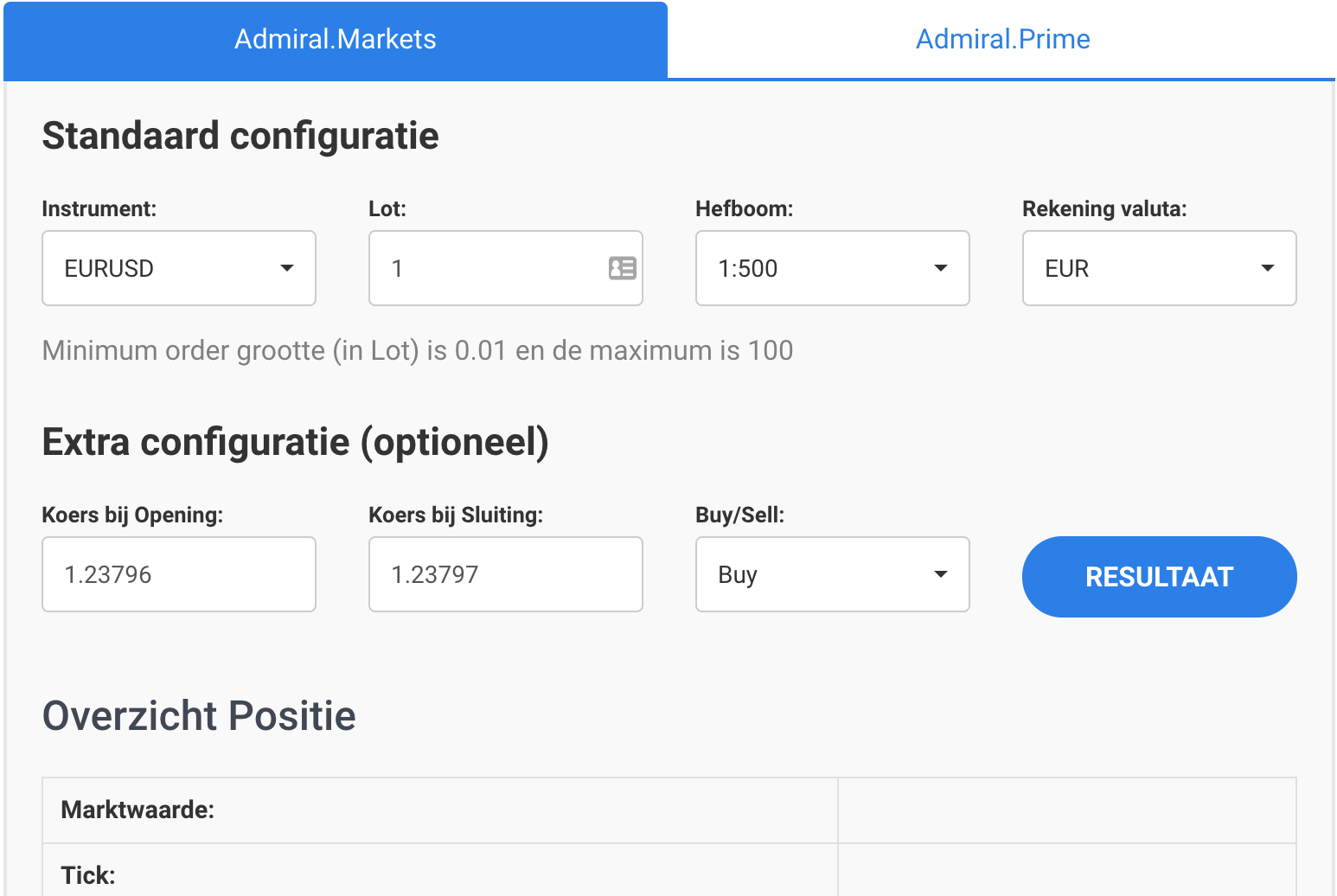

Marge Trading en Margin Trading in Forex en CFD

Marge Trading en Margin Trading in Forex en CFD

Comments

Post a Comment